If healthcare in America weren’t so egregiously expensive, more people would retire earlier and live better, happier lives. We’re one of the few countries in the world where affordable healthcare is tied to employment, making financial independence that much harder to achieve.

Given the high cost of coverage, before you decide to retire early by choice, try to negotiate a severance package and use your final year of work to get in the best shape of your life. Think of it as investing in your future health dividends. The stronger and healthier you are, the less likely you’ll need to rely on costly medical care. In addition, the longer you can stretch your freedom dollars.

My Decision To Voluntarily Retire Early While Considering Healthcare Costs

When I voluntarily retired in 2012, one of my biggest concerns was figuring out how to pay for healthcare. For 13 years, my employers had subsidized a portion of my premiums through a group plan. Instead of paying $850 a month for coverage, I was only paying around $375 toward the end.

So when I left work, after my 6 months of 100% subsidies healthcare ran out as part of my severance package, I faced an $850 monthly bill as a healthy 34-year-old who barely used the system. It felt excessive and I needed a plan.

At the time, I asked my 31-year-old wife not to YOLO her career away with me. Instead, I encouraged her to embrace equality and keep working another three years to ensure my risky move wouldn’t put our household in financial jeopardy. Thankfully, she agreed.

During that time, she maintained her employer-sponsored healthcare plan, which also covered me. Many of her colleagues had family coverage anyway, so joining her plan was perfectly normal.

Our Cost For Healthcare Is Expensive

In 2015, at age 34, we finally initiated the process of engineering her own layoff as a high-performer to receive a severance package. We knew we’d lose our healthcare subsidy and have to pay about $1,680 a month, but this was a conscious choice we made in exchange for freedom. It felt wrong to manipulate our income just to qualify for government healthcare subsidies when we could afford to pay full price.

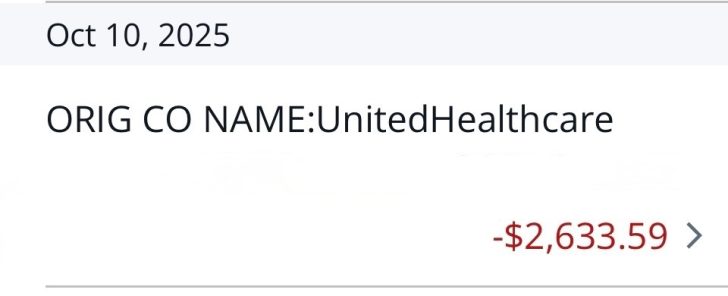

Today, for our household of four, we pay $2,633.59 a month in unsubsidized premiums for a Silver plan, not even a Gold or Platinum plan. $2,633.59 doesn’t sound affordable to me, despite the government calling it the “Affordable Care Act.” Next year, our monthly premium is expected to jump to $3,000. But the way the system works is that those who make more than 400% of the Federal Poverty Limit subsidize those who do not.

In essence, we have a high deductible health insurance plan. I’m hoping my new investment in value stock UnitedHealthcare will help us pay for our premiums in the future. UNH certainly makes a fortune from us.

The reality is, plenty of early retirees take advantage of healthcare subsidies—even if they’re millionaires or multi-millionaires. Some even brag about it online. That’s always rubbed me the wrong way, because I doubt the government’s intent was to subsidize the top 6% of wealth holders. Or maybe it was so our politicians are mostly millionaires.

For example, let’s say you have a $2 million portfolio generating $80,000 a year in income. As dual unemployed parents (DUPs) with two children, your household income is around 250% of the Federal Poverty Level (FPL), which qualifies you for heavy healthcare subsidies. Remember, subsidies extend all the way up to 400% of the FPL.

That means a household with a $5 million growth-stock-heavy portfolio earning only a 1.3% dividend yield—roughly $65,000 a year—would sit around 210% of the FPL and qualify for a 90%+ discount on healthcare premiums. Instead of a family of 4 paying $3,000 a month, they’d pay just $300 a month or less. Pretty incredible!

The Debate in Congress Over Extending Healthcare Subsidies

Congress is currently debating whether to extend the enhanced healthcare subsidies for households earning above 400% of the Federal Poverty Level. Democrats want to make the temporary expansion permanent, while Republicans prefer reverting to the original rules.

The American Rescue Plan Act of 2021, under the Democrats, temporarily raised the value of the premium tax credits and expanded eligibility beyond 400% of FPL. These “enhanced” subsidies capped a household’s premium costs at 8.5% of income.

Then, in 2022, the Inflation Reduction Act, under the Democrats, extended those enhanced subsidies through 2025. Now they’re set to expire at the end of 2025 under the Trump administration.

According to the Congressional Budget Office, extending these enhanced subsidies would cost about $350 billion over 10 years, or $35 billion a year. Not great given the size of the existing budget deficit.

Costs Reverting Back To The Old Trajectory

Without the extension, the average 60-year-old couple making $85,000 a year (just over 400% of FPL) would see premiums jump by $1,900 a month, or nearly $23,000 a year in 2026, according to KFF. If true, that is an egregious amount to pay under the “Affordable Care Act.” However, that also means the 60-year-old couple has had at least $91,200 in healthcare subsidies since the American Rescue Plan Act of 2021 passed.

If that $91,200 in healthcare subsidies was saved or invested since 2021, as all renters say they do to justify not buying a primary residence, they have enough to pay for the next four years of higher healthcare premiums. At least, that’s how personal finance enthusiasts think.

Fighting to Keep Subsidies for Early Retiree Millionaires Feels Off

But doesn’t arguing for more healthcare subsidies for millionaires feel a little off to you? If you make $85,000 a year as a retired couple, that means your pension or investments are worth $2,125,000 at a 4% safe withdrawal rate! Most people would argue you’ll be alright, especially if you have no debt. And if you’re an early retiree with that type of net worth, then receiving subsidies seems completely strange.

CNBC recently profiled a “early retiree” couple, Bill (61) and Shelly (59), who will earn $127,000 a year in pension income in 2026—above the 400% FPL threshold. Their premiums would rise from $442 a month to $1,700, which sounds more realistic than KFF’s above estimate. That’s painful, but they’ve also enjoyed roughly $70,000 in enhanced premium tax credits since 2021.

Still, a $127,000 pension is worth roughly $3.2 million in annuity value at a 4% rate of return. Should the ACA really be subsidizing retirees with multimillion-dollar pensions and portfolios? Resources should focus on those without six-figure pensions or significant savings. You know, the ~85% of Americans who don’t have lifetime pensions.

No one in America should have to suffer through a health crisis simply because they can’t afford care. Healthcare is a basic right, not a privilege. Therefore, redirecting healthcare subsidies toward the lower middle class and poor makes far more logical sense.

Capitalize The Value Of Your Pension And Investment Income

Now I’m starting to wonder — do the average American, financial reporter, or politician not know how to capitalize the value of an income stream to determine its true worth? We do this all the time in finance, and on Financial Samurai. Simply take a reasonable rate of return or withdrawal rate—say 4% or 5%—and divide your pension or investment income by that number.

Let’s find out the capitalized value of a pension based on various Federal Poverty Level (FPL) income limits for a family of four:

- $31,200 (100% of FPL): $624,000 – $780,000 pension value. You’ll likely qualify for 100% subsidies and pay 0% of your income toward healthcare premiums.

- $43,056 (138% of FPL): $861,120 – $1,076,400 pension value. You’ll likely pay 0–2% of income toward premiums after subsidies — roughly $0 to $50/month for a Silver plan in many states.

- $46,800 (150% of FPL): $936,000 – $1,170,000 pension value. You’ll likely pay 1–2% of income, or about $0 to $80/month for a Silver plan.

- $62,400 (200% of FPL): $1,248,000 – $1,560,000 pension value. Expect to pay 2–2.5% of income, roughly $50 to $100/month.

- $78,000 (250% of FPL): $1,560,000 – $1,950,000 pension value. You’ll likely pay around 4% of income, or $180–$220/month.

- $93,600 (300% of FPL): $1,872,000 – $2,340,000 pension value. You’ll likely pay about 6% of income, or $300–$350/month for a Silver plan.

- $124,800 (400% of FPL): $2,496,000 – $3,120,000 pension value. You’ll likely pay up to 8.5% of income, or roughly $450–$550/month for a Silver plan.

If you have a lifetime pension or passive investment income that generates $31,200 a year or more (100% of FPL), you’re doing pretty well compared to the average worker or retiree. Hence, to pay little-to-nothing towards the healthcare system seems off.

Adapting to the System Of Embracing The Wealthy

That said, we should look at this debate as a reflection of the times and adapt accordingly. Just as we practice identity diversification depending on who’s in power, we can lean into our wealth when the government decides to subsidize the wealthy.

If the government wants to hand out healthcare subsidies to six-figure pensioners and multi-millionaires, then the rational economist says: take the free money. After all, most politicians are over 40 and already wealthy, so it’s only natural they design policies that benefit their own demographic.

However, political winds always shift. When they do, and policymakers refocus on helping the true middle class and poor, it’ll once again be time for the wealthy to pay full freight.

Will Continue To Pay Full Freight To Help America

With our current level of passive income, we’ll never qualify for healthcare subsidies. Our household expenses are also too high to purposefully lower our income at the moment. And that’s probably how it should be. For the greater good of society!

In the meantime, I’ll keep doing my best to stay in shape so I can subsidize and make room for those who can’t or won’t. Just as it’s a privilege to pay taxes to support those who pay less or none at all, it’s also a privilege to be healthy enough to help offset the costs for those who aren’t.

Readers, do you think the government should be fighting to provide healthcare subsidies for the wealthy? Or is it irresponsible to extend these enhanced tax credits given our massive budget deficit? Where should we draw the line when it comes to offering healthcare subsidies?

Recommendation To Protect Your Loved Ones

Besides regularly working out and eating healthy to extend your life, you should also get an affordable term life insurance policy to protect your loved ones.

Both my wife and I got matching 20-year term policies through Policygenius. Simply input your information and you’ll receive real quotes from vetted life insurance carriers within minutes. If you have debt and dependents, getting life insurance is one of the most responsible things you can do.

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population and break free sooner. As you can tell from my post, the government loves millionaires by showering them with healthcare subsidies.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here.

Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.