CardPointers

Product Name: CardPointers

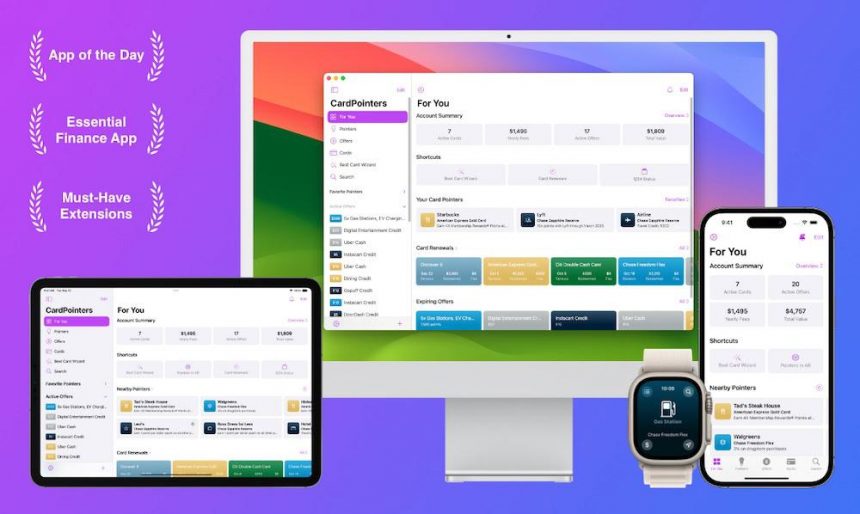

Product Description: CardPointers is an app that helps you maximize the rewards you earn from your credit cards. Includes a browser extension (Chrome, Safari) that automatically adds special offers.

About CardPointers

CardPointers is an app that helps you maximize your credit card rewards by help you know which benefits are available from which card. It also has features to help you track limited time offers, automatically add offers to your card (Chase, Bank of America, Citi, AMEX), and more.

Pros

- Easy to setup, requires no sensitive information

- Very easy to use, helps you remember which card to use

- Automatically add limited time offers via extension

- Tracking features help you maximize benefits

Cons

- Free version has limited functionality

If you use just a couple of credit cards, it’s easy to remember the best one to use and when.

But if you have more than a few, juggling them can be challenging. Also, as card benefits are constantly being added and removed, changing with limited time promotions, keeping track of what is best becomes even harder. Almost impossible.

But there’s a tool that can help solve that problem.

The one I like the most is CardPointers.

Cardpointers+ Partnership Launch Sale

For a limited time, Cardpointers is running a 50% off sale on their Annual and Lifetime subscriptions for Cardpointers+.

This makes the Annual price just $36, or $3 a month, and their Lifetime price only $120.

Any link on the site will have the sale price listed, or you can click below:

Table of Contents

What is CardPointers?

CardPointers is an app and browser extension that can help you optimize your credit card spending so you maximize their value. It will help you keep track of rewards and bonuses so you are always taking advantage of the best offers. It also helps you track benefits that may be limited on a monthly or annual basis, so you don’t have to remember yourself.

For example, I have a Southwest Rapid Rewards Card that gets four Upgraded Boardings reimbursed each year. I know I’ve used two and have two left, but with CardPointers I can let it keep track so I don’t need to remember anything. I also have $75 in Southwest credit to use each year – something I definitely want to spend because it’s free money.

That’s just one card. There are loads of benefits from all the other cards I have.

Before I get to into the weeds on the features, here’s the pricing.

- For free, CardPointers offers a small subset of their features so you can see what it can do – add one card, limited tracking of usage, but costs nothing. You can see how it can help without paying.

- CardPointers+ is only $6 per month, or $72 per year, and you can track all of your credit cards, all of your spending and which card you should use, and a whole host of features I’ll share below.

⭐ First, check out what CardPointers can do and then we have a special offer (or click that link to jump down and see it) below for Best Wallet Hacks readers.

How to Set up CardPointers

The first step is to go to CardPointers.com and download the app for your device. They support Apple, Android, Chrome, and Firefox.

Once you open you app, add all of the credit cards you use. You don’t need to know your credit card numbers, just the name of the card – like Chase Freedom, American Express Gold, etc.

CardPointers keeps track of the cashback schedules, bonuses, cashback limits, and other details for you. They don’t need to know your actual credit card number and you never have to log into your bank. They support over 5,000 cards in the United States and Canada.

📅 One nice feature is you can record the date your card was approved, so it can track when the annual fee will come due. This lets you call in for a retention offer or cancel the card.

I found the tracking of monthly limits to be clever. You have to track this manually since they don’t record your specific card information:

Pointers Tab: Always Know The Best Card To Use

Once you’ve added all of your cards, the Pointers section shows you the best card to use in which category:

No more guessing which card is best.

If you are comfortable with CardPointers knowing where you are, you can use AutoPilot and it will recommend what card to use on your lock screen (you can turn it on and off) based on where you are standing. If you’re in a Target, it’ll recommend the best card for Target. You can toggle on and off AutoPilot from within the app so you’re not constantly messing with your Settings to turn it on and off.

If you want to see something really cool, “Pointers in AR” is a feature that uses the camera and will scan the store to tell you which card to use. Seems a bit overkill but it’s cool.

Offers Tab: Lists All Limited Time Offers

The Offers Tab is great because it’ll track all of those special offers and lets you update the limits right on the screen:

I find it really hard to remember these, especially the smaller ones like $10 here or there. We use Instacart and DoorDash on an irregular basis, I just don’t care enough to search for which card offers a $10 credit especially when I’m away from home or busy. But I’m willing to open up the app and find out in five seconds, it’s like leaning down to pick up a $10 bill – I’m doing it.

But Offers is even better when you use the browser extension.

Chrome/Safari Extension: Activates Offers

My favorite feature is their browser extension (Chrome and Safari) called CardPointers X. It will “activate” all those special offers you see in your account. They support American Express, Chase, Bank of America, and Citi.

For example, did you know that for a limited time, Chase will give you $250 if you spend $1,000 or more at Tonal. If you were going to be dropping a grand, wouldn’t you want to know about and, more importantly, activate this offer before your purchase?

Honestly, I’d be furious if I made a purchase and missed out on $250 because I failed to “activate” this offer.

CardPointers’ extension will just turn on all the offers for you.

And now you can see they all have green checks:

I don’t see why you wouldn’t want CardPointers to activate them all but if you want to do it manually, or pick and choose, you can do so too:

Once you have all the offers added, you can go back to the offers tab to see them all. You can search, use the AutoPilot tool, and automatically know which card to use to take advantage of these offers, even the limited time ones.

Finally, when you visit websites, there will be a small pop-up at the bottom of the page that tells you which of your cards is best – here it what is showed on Southwest.com:

I found this popup to be a bit annoying and fortunately you can turn it off. Right click the extension and go to “Manage Extension.”

Under “Site access,” I switch the setting for “Allow this extension to read and change all your data on websites you visit:” from “On all sites” to “On Click.”

This removes this pop up and if you want to know which card is best, you can click the extension to find out.

Special Offer: 50% Off

We partnered with CardPointers to get you 50% off the regular price. You can get the annual subscription for just $36 (instead of $72) after a 7-day free trial.

If you want to buy a lifetime subscription, that’s only $120 plus they give you a free $100 savings card you can use with one of their partners (I’d treat that as gravy if you can use it). Even the lifetime subscription of $120 is just over two years of fees compared to regular price.

Summary

I don’t juggle half a dozen credit cards, we use just three on a daily basis (and even then, mostly two), but now that I have CardPointers, I’m going to add of my cards to see if I’m leaving some cash on the table.

The biggest draw for me with CardPointers was the browser extension. I know that my Chase and American Express cards have these special offers (hundreds of them) but I have no interest in scanning page after page of offers on the off chance I might see something I can use. Plus, I don’t like the idea of an offer pushing me to spend, I’d rather let need dictate that and get the pleasant surprise of a discount.

For $72 a year (normal price, not our special discounted price), I can make sure every offer is added and before major purchases, I’ll double check CardPointers to make sure I’m not missing an offer or favorable cashback offer.

Other Posts You May Enjoy:

What States Collect Sales Tax When Buying Costco Gold

It was big news when Costco started selling gold bars, but did you know that only a handful of states collect sales tax on it? Here’s where you will and won’t pay tax on your purchase.

PFS Buyer Club Deal Review: Make a Profit as a Coin Buyer

PFS Buyer Club will pay you to buy coins from the Mint and sell them to their buyers. It’s a fun way to turn a small profit without much work.

Over Roth IRA Income Limits? 4 Ways You Can Still Contribute

The Roth IRA is an amazing investment vehicle and one that the government limits if you make too much money – but fortunately there are ways around it. 😂

How my thinking about money has changed over 20 years (and what hasn’t)

As I pass through my mid-forties, my approach to money is much different than what it was in my twenties. Here’s how it’s evolved and why I think that’s a good thing.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.